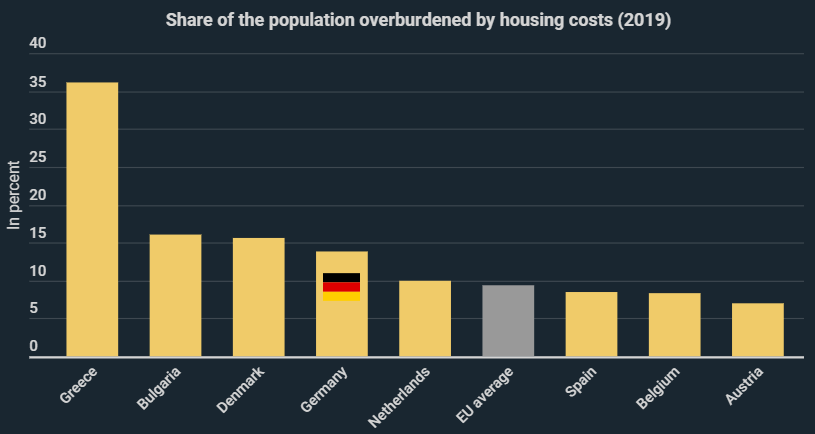

13.9% of Germans are struggling with the cost of housing. In the EU, the average is 9.3%. As can be seen in a new infographic from Kryptoszene.de, rent price increases are affecting more and more citizens – sometimes to the advantage of those who were lucky enough to have invested in real estate at the right time. Shares associated with real estate have been among the winners of the hour.

While Germans are above average in terms of housing costs, the situation in Greece is particularly striking. Here 36.2% struggle with the cost of housing. Bulgaria ranks second, based on data from the Federal Statistical Office, followed by Denmark and Germany.

Germans spend around 35.62% of their disposable income on housing, energy and maintenance, representing by far their largest single expense. Particularly in metropolitan areas across the West, a large proportion of income ends up in the residential sector. Inhabitants of Munich spend on average 29.5% of their income on rent.

Real Estate Stocks Paying Dividends

As the infographics show, the housing rental index has climbed from 103.9 to 106.9 points since June 2018. This trend of rising rents has continued throughout the corona crisis.

A look at the performance of selected stocks shows that real estate firms have recently benefitted considerably from this trend. Deutsche Wohnen’s market value climbed 26.9% in the last year, while DAX competitors Vonovia also gained 15.9% – all of this over a period in which the DAX has shed around 10% of its value.

Despite such strong performance, demand on Google for the search term pair „real estate stocks“ remains subdued. The Google trend score, indicating relative search volume, is currently at 34, with a value of 100 representing the greatest possible interest.

Folgen Sie uns auf Google News