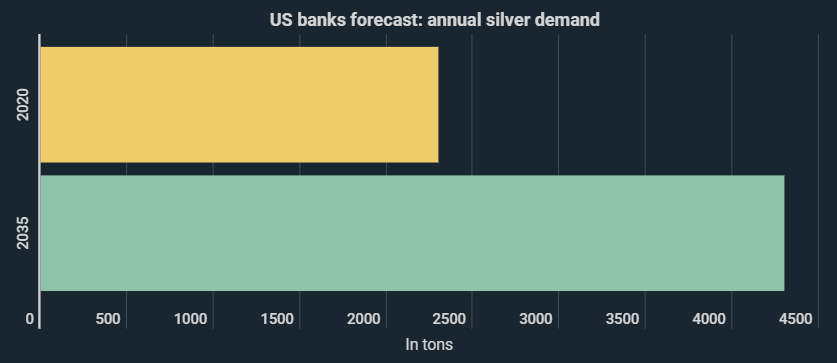

US banks are predicting demand for silver to rise almost 90% by 2035. As a new infographic from Kryptoszene.de shows, silver is already the asset class of the hour.

Annual global demand for silver currently amounts to 2,300 tonnes. This is projected to increase to 4,300 tonnes by 2035, according to forecasts by US banks, as reported by „Focus“. The report also suggested that there could even be excessive demand, due not least to higher demand from the solar energy industry which should cause the price of silver to rise.

Meanwhile, more and more investors are placing their money in silver ETFs. Silver assets held by such funds increased by 9,237 tonnes in the first three quarters. The increase over the same period last year was 3,203 tonnes, according to data from „The Silver Institute“.

Silver Price Trend

The price of silver is currently quoted at $24.30 US per troy ounce, compared to $14.88 US in March. The increase over this period amounts to 63.3%. Meanwhile the price of physical coins has risen even faster due to supply bottlenecks.

A comparison with other assets highlights the strength of silver’s performance. As the infographics show, the price of crude oil has crashed 33% since the beginning of the year, while the DAX has lost 1.6% in value. While gold rose strongly by 19.7%, the gains for silver are much higher.

Investor Interest

The performance of silver ETFs is proof that the precious metal has certainly aroused investors‘ interest. Nonetheless, analysis of Google search queries indicates that the vast majority of investors still seem to regard the potential as low. The Google trend score for the search term pair „buy silver“ stands at 34 in a 12-month review. A value of one hundred stands for the highest possible relative search volume.

Folgen Sie uns auf Google News