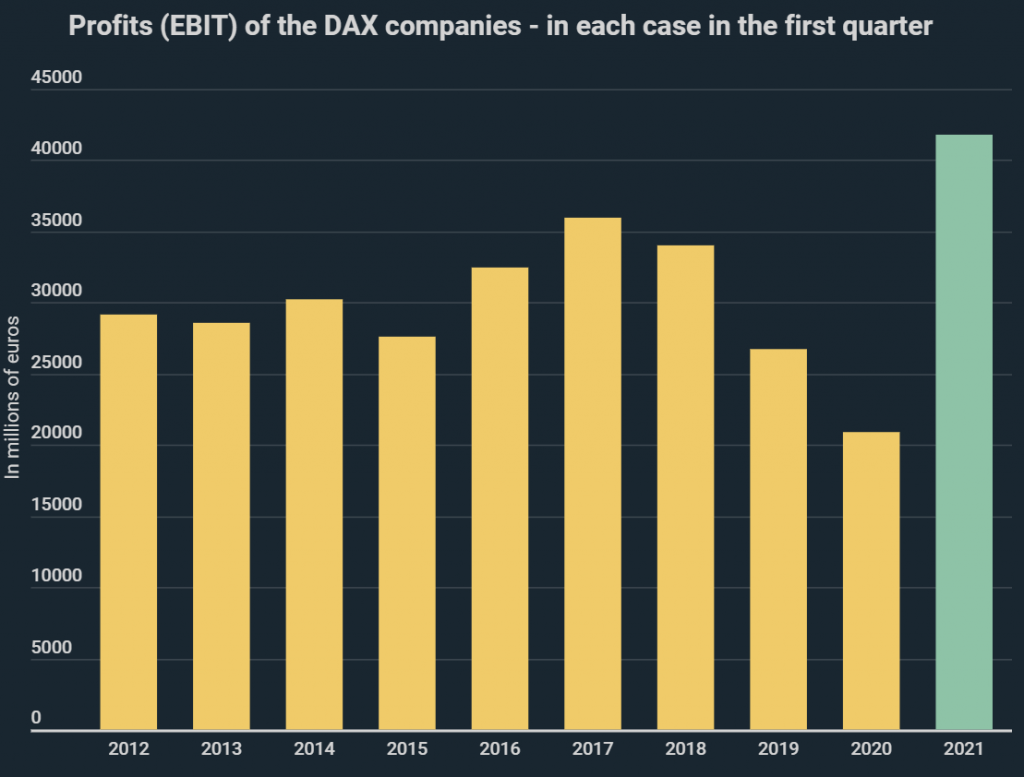

DAX companies achieved profits totalling €41.8 billion in the first quarter – up from €20.85 billion in the previous year. Yet even compared to the year before the Corona crisis this represents an increase in profits of 56.3%, as shown in a new infographic from Kryptoszene.de.

While few people are bothered by profits per se, some companies‘ dividend policies have come under fire. For example, Daimler increased its profit distribution from 90 cents (2020) to €1.35 (2021). 83% of German citizens regard the car company’s dividend policy as wrong, in part because the Stuttgart-based company, like many other companies, has taken advantage of the government’s furlough scheme.

As the infographic shows, there is nothing new about this trend towards higher dividends. Between 2011 and 2017, dividends in the top seven industrialised countries rose by an average of 31% across sectors, while wages increased by just 3%.

Golden Times

E.ON has the highest dividend yield out of the DAX companies, amounting to 5.33%. BASF comes in second place, followed by Allianz and Bayer.

While the pandemic continues to hold the world in its grip, the prices of numerous assets are rising sharply. This is also having an impact on the fortunes of the super-rich. In February 2019, the 10 richest Germans owned about $179.3 billion US, while in December 2020 this had already risen to $242 billion. Germany’s national debt has also risen significantly, increasing from 59.6% (2019) to 71.2% of GDP (2020).

Folgen Sie uns auf Google News