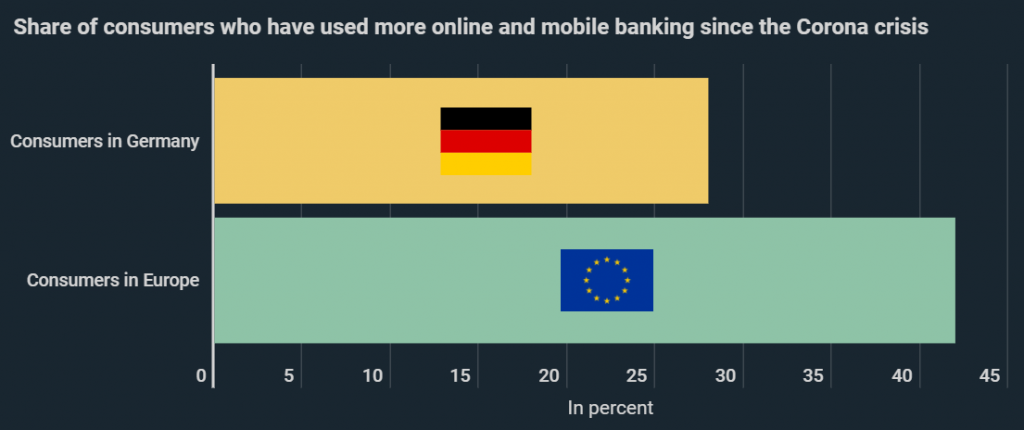

Since the pandemic, 28% of Germans use online payment options more frequently. However, across Europe 42% of consumers are making increased use of online banking. As a new infographic by Kryptoszene.de shows, Germans‘ use of digital payment methods remains comparatively low.

A similar picture emerges in the case of card payments. Since the corona crisis, 41.9% of Germans pay more frequently by card; across Europe the figure is 51.7%.

Meanwhile, 73% of Germans are now using online banking, compared to just 53% in 2014, according to data from Bitkom. Nevertheless, Germany remains far behind in an EU comparison; as many as 95% of Norwegian citizens use online banking.

Tough Times for Traditional Banks

The infographic also shows that more than half of all Europeans can imagine switching to a digital bank. New banks such as N26, Revolut & Co. have been benefiting from this trend for some time now.

According to data from a survey conducted by Mastercard, 61% of Europeans are convinced that the use of digital banks can save time. Other benefits include ease of use, high availability and lifestyle features.

Digital banks often rely on smartphones as an end device. This is one factor that Germans at least see as a downside. 77% are afraid of smartphone theft and subsequent fraud. In addition to the concern of identity theft, another 69% stress that mobile payments could lead to hasty purchase decisions.

Folgen Sie uns auf Google News