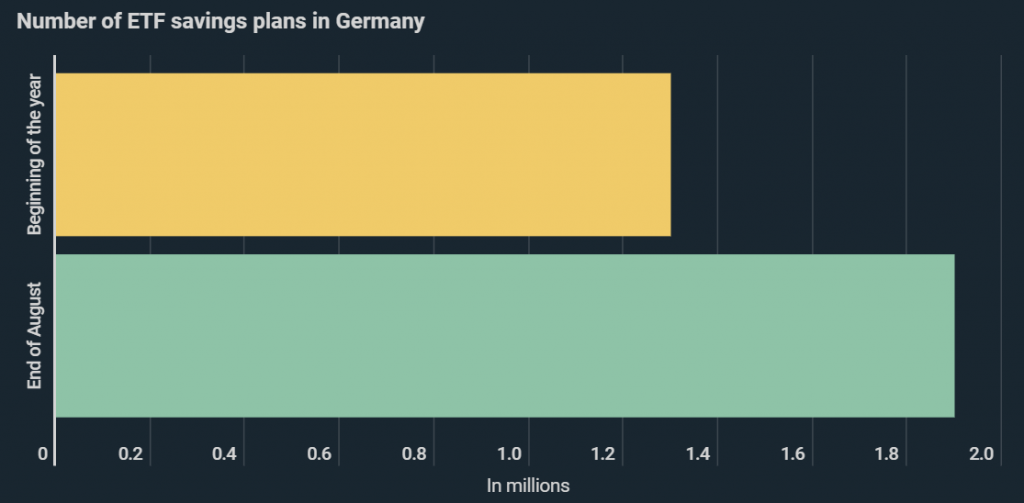

Within the space of well under a year, the number of active ETF savings plans in Germany has climbed from 1.3 to 1.9 million. As a new infographic from Kryptoszene.de shows, the average savings contribution also rose concurrently from €167 to €178.

Analyses of Google data demonstrate that regular automated stock investments are becoming increasingly popular alongside ETF savings plans. At the beginning of September, the Google trend score for the search term pair „Aktien Sparplan“ (“shares saving plan”) hit the highest possible value of 100. At no time in the last 365 days were more people in Germany searching for these terms. The relative demand is especially high in Hamburg and the states of Bavaria and Baden-Württemberg.

ETF Savings Plans In Vogue

It remains to be seen how high the returns will be on a recently activated savings plan. In the past, however, similar investments in broadly diversified ETFs have paid off – if you’d transferred €200 per month to the overnight deposit account for the last 20 years, your assets would now amount to €52,600. If you had invested €200 a month in the MSCI World ETF, you would now have €99,635. This is according to calculations of the comparison portal „Test.de“.

Meanwhile, the infographics show that shares and funds are also becoming increasingly popular as a means of saving for retirement. 20% of Germans under the age of 45 regard investments in shares, bonds and funds as the most trustworthy form of retirement provision. Only 16% consider the statutory pension scheme to be the safest or most trustworthy, as reported by „Digitaldaily“.

Folgen Sie uns auf Google News