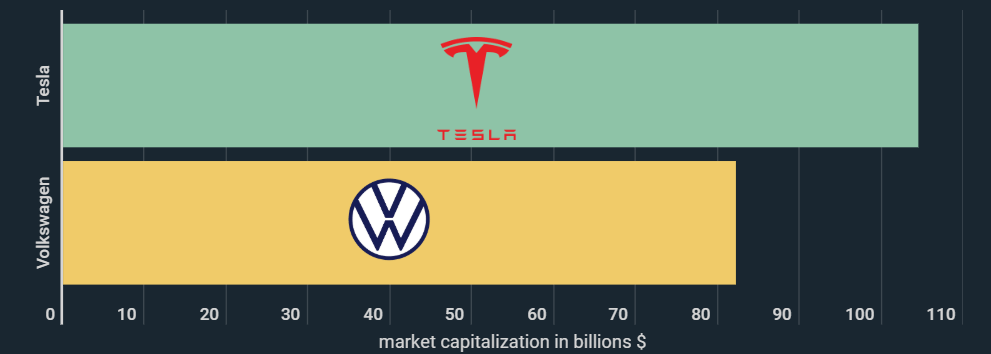

At the end of January, Tesla overtook Volkswagen in market capitalization. Both car companies are fighting for their place in the e-segment. They are, however, competing in an uneven duel, according to the infographic by Kryptoszene.de. For example, in the fourth quarter of 2019, Volkswagen sold 1,474% more cars than Tesla. VW’s research budget also exceeds Tesla’s by far.

In the last three months of last year, Volkswagen sold around 1.76 million vehicles. Tesla, in comparison, about 112,00. Nevertheless, the US group’s market capitalization has exceeded that of Volkswagen on January 22. The company is now valued at more than VW and Deutsche Bank together.

Less than a year ago, „Tagesschau“ asked a question, whether there will be a Tesla 2020 at all. Current figures suggest that the car manufacturer’s demise seems to be way off the table: In the past 6 months alone, the price of Tesla shares increased by about 222%. During the same period, Volkswagen grew by around 11%. At the same time, Volkswagen keeps emphasizing that the German company has launched an „unprecedented electric offensive”.

In the world of car sales, Volkswagen is far ahead, which cannot be said about the segment of electric cars. In this realm, Tesla sold 367,561 vehicles last year, VW – only 80,000. A look at the bare figures of the two companies, however, suggests that Volkswagen is well equipped to overtake Tesla as the electrical market leader.

Tesla and Volkswagen: Annual Sales Growth

Since 2013, Tesla sales have increased by around 1,121%. With Volkswagen, sales growth is just under 26%. There is also a significant gap in absolute sales: Tesla generated $24.58 billion last year, while Volkswagen (estimate, last quarter figures not yet available) generated $247.89 billion.

A look at corporate earnings is also very insightful: between Q3 2018 and Q3 2019, Tesla suffered a loss (EBIT) of around $13 million. Volkswagen’s situation is entirely different: gross profit in the said period is approximately $18.33 billion.

Although Tesla is considered to be innovative or even a pioneer in the electronic car segment, Volkswagen has a significantly higher research budget. In 2018, Tesla invested around $1.46 billion in research, while Volkswagen spent $15.8 billion. As a result, Tesla’s potential research advancement does not seem to be that unbeatable given the German company’s budget.

Different VW and Tesla Shares Price Development Despite Similar Objectives

VW CEO Herbert Diess told „FAZ“ that he plans to make Volkswagen the largest electric car manufacturer. With „many new models,“ he wanted to “make the breakthrough with the electric cars, […] achieve fleet emissions targets, and, through this, hold our margin„. However, there the stock exchange does not seem to be particularly euphoric, either about Volkswagen shares or about Tesla securities. Volkswagen is the cheapest share both in DAX and in the entire industry.

However, there are also similarities. Both companies have a similarly high leverage ratio, as shown on from the infographic. Tesla’s is 78.77%, Volkswagen’s – 78.38%.

Folgen Sie uns auf Google News