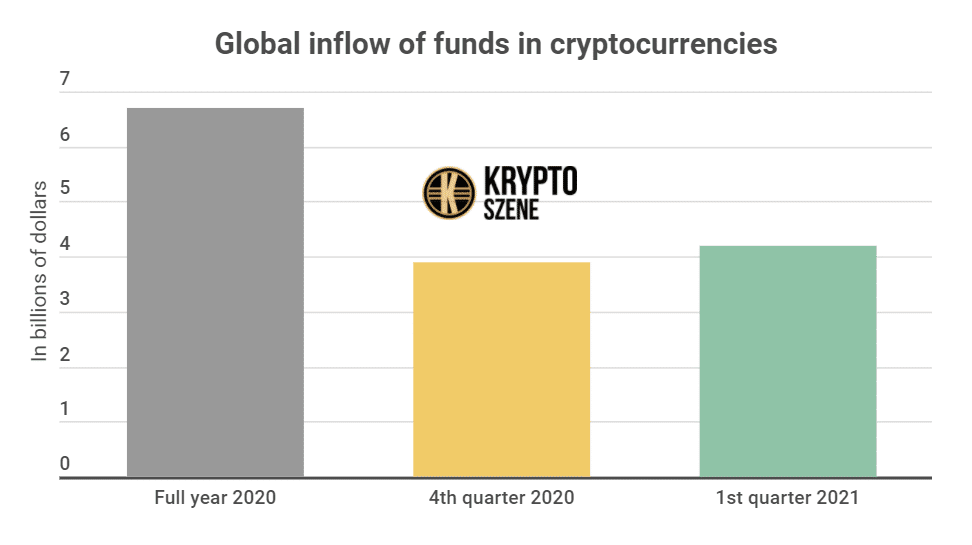

The influx of funds into cryptocurrencies in the first quarter of this still-young year alone amounted to $4.2 billion US. As a new infographic by Kryptoszene.de shows, 79% of this went into bitcoin, the largest digital currency by market capitalisation. Ethereum was in second place.

To put this in perspective, the total inflow of funds into cryptocurrencies in 2020 amounted to $6.7 billion. Bitcoin again accounted for the lion’s share, as shown by data from a study conducted by Coinshares.

An analysis of searches on Google also suggests that users‘ interest in Bitcoin has risen sharply in 2021. At the beginning of March, more people were looking into buying bitcoin than at any point in the last year. As can be seen in the infographic, the Google Trends Score, an indication of the relative volume of searches for bitcoin, reached the maximum value of one hundred.

Patient Investors

Meanwhile, the infographic reveals that just under 18% of all bitcoin in circulation has not been moved in the past 7 years – and this in spite of the fact that its price has risen considerably since then.

Yet there certainly is movement in the market, potentially more than ever before. Faced with the US government’s upcoming financial stimulus in response to the Corona crisis, 40% of US citizens report plans to invest money in stocks or bitcoin, with bitcoin proving even more popular among these investors than securities.

If the rally continues, these investments could more than pay off. The price of bitcoin has risen by 719.6% in the last 12 months. Gold, the traditional asset in times of crisis, gained just 6.7% over the same period.

Folgen Sie uns auf Google News