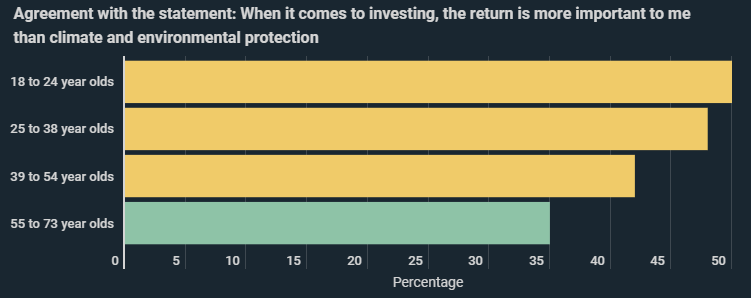

50% of 18 to 24-year-olds consider returns on investment more important than climate and environmental protection. Among 55 to 73-year-olds, the proportion is just 35%. This is the result of a new infographic from Kryptoszene.de. Green stocks and ETFs are nevertheless on the rise, as a performance comparison clearly shows.

There are clear differences between the sexes in terms of investment behaviour. According to a study commissioned by Santander, 54% of women indicated that they would pay more attention in the future to climate and environmental protection when investing. For men, however, the figure is 40%.

There is, however, also a significant degree of uncertainty. A clear majority of Germans find it difficult to understand what kinds of investment benefit the environment and climate and which do not. Uncertainty is felt strongest among 25 to 38 year-olds. Here, 80% say they are not fully aware of the situation.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Sustainable Investment in Focus

At the same time, the infographic shows that the investment volume into sustainable investment funds and portfolios is growing rapidly in Germany. This is revealed by data from the Market Report for Sustainable Investments 2020. Last year, investment volume reached €183.5 billion, compared to €69 billion in 2015, representing an increase of 166%.

In particular, a look at the volume of sustainable investment coming from private investors reveals that there has been a drastic change recently. The volume increased by 96% in Germany from 2018 to 2019. The annual growth rate between 2012 and 2018 had averaged 8%, as show in the infographic.

Green Stocks Winners of the Crisis

Looking at annual performance, it is clear that green stocks and ETFs are posting significantly higher gains compared to traditional assets. The price of Enphase Energy, for example, has risen by 189%. PowerCellSweden, based in the hydrogen sector, has also risen by 171% in terms of market capitalisation. In retrospect, the Global Clean Energy ETF rose 42% year-on-year, while the Dow Jones and DAX gained only 3% and 7% respectively.

Folgen Sie uns auf Google News