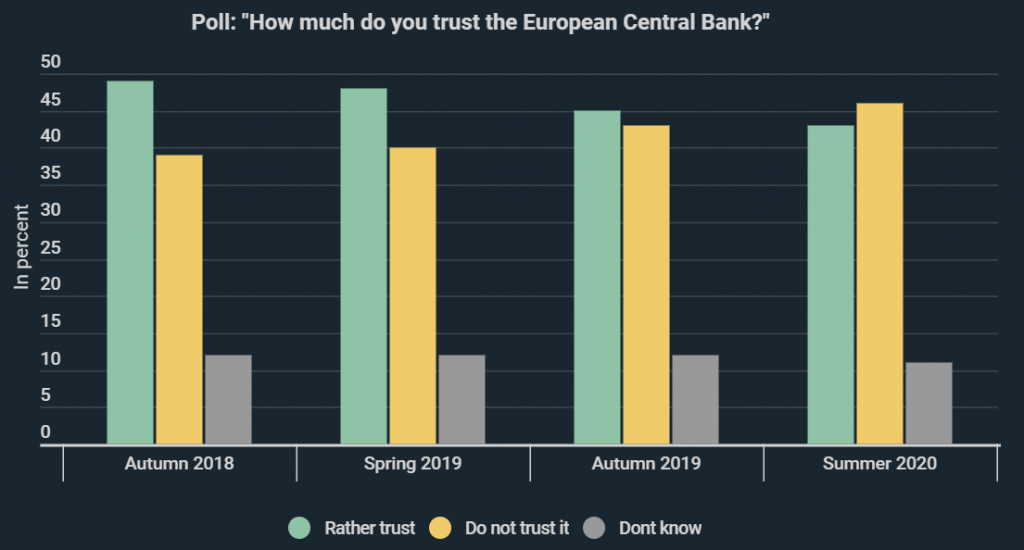

A mere 43% of German citizens have confidence in the European Central Bank (ECB). Trust in the European Union institution has been falling since autumn 2018 – with the pandemic seemingly fuelling the trend. As can be seen in new infographic from Kryptoszene.de, scepticism could be one of the drivers of Bitcoin & Co.’s rally.

Citizens‘ faith in the ECB was on the rise between 2016 and the autumn of 2018, but has been waning since then, as shown by data from „Eurobarometer“. The central bank’s concrete policies aside, there is a growing mistrust in the general stability of the financial and monetary system, as expressed by Professor of Economic Policy Gunther Schnabl, among others.

Data from a DFVA survey suggests that cryptocurrencies such as Bitcoin stand to benefit from this. According to the survey, 5% of professional investors are of the opinion that distrust in the current monetary system is a strong price driver. The price of Bitcoin has risen by around 412% in the past 365 days.

Crisis-Proofing

Meanwhile, Germans also appear to be relying more on cash. As the infographic shows, just under one in five people thinks of cash as a means for citizens to protect themselves against bank and state bankruptcies, according results from a study conducted by the Deutsche Bundesbank.

There were €1,231 billion of cash in circulation across the entire eurozone in 2019, compared to €240 billion in 2001. This amounts to an increase of 412%.

Confidence is a central bank’s most important asset. It has been damaged recently, possibly in part due to loose monetary policy in response to the Corona crisis. While it does not seem to have reached a critical level yet, alternative currencies are already reaping the benefits.

Folgen Sie uns auf Google News