People who work in the finance and insurance sector on average are borrowing the most money. The average loan amounts to 16,346 euros, as shown in data from „Check 24“. A new infographic by Kryptoszene.de reveals that more and more German citizens are concerned about their outstanding loans, while at the same time showing a tendency towards risky investments.

Around one in three Germans are currently worried about running up or repaying a debt. For 30 to 39-year-olds, the figure is as high as 51%. The main reason behind this is the Corona crisis and the extraordinary financial burdens that have come with it. This was the conclusion of a Kantar survey commissioned by Postbank.

However, citizens are not the only ones deeply in debt. The federal government’s debt levels are also reaching new highs. Before the Corona crisis, the federal government had debts of 1.3 trillion euros; according to current forecasts, this figure will have risen to around 1.75 trillion euros by the time it’s over.

Different Approaches

Opinions differ on the best way to cope with the economic situation. While slightly more than one in four German citizens consider tax increases necessary to tackle the piles of debt, one in two is in favour of tax cuts.

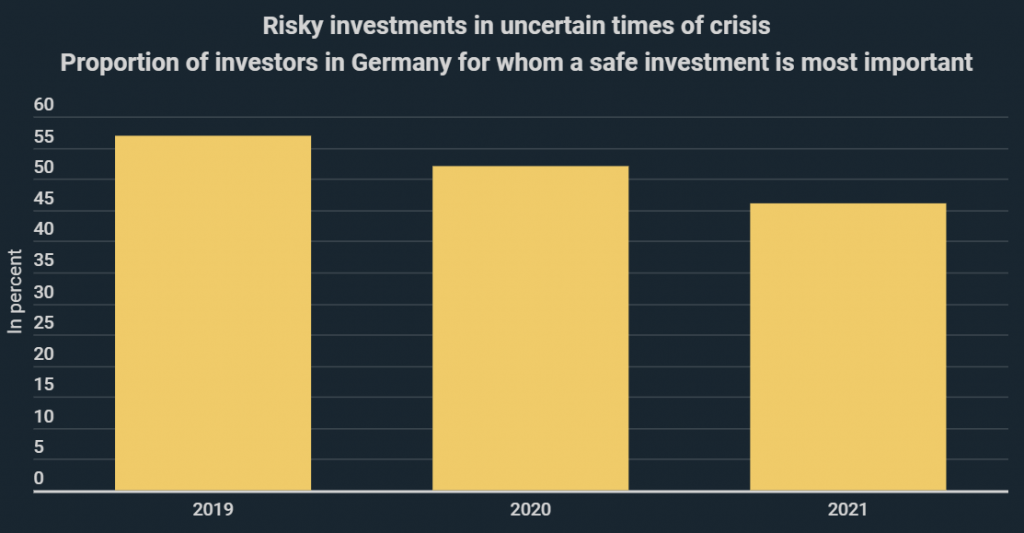

Economic uncertainties and high debt levels aside, citizens appear to be taking ever higher risks in their investments. This year, 46% of investors indicated that a safe investment was most attractive to them, compared to 57% two years ago.

Folgen Sie uns auf Google News