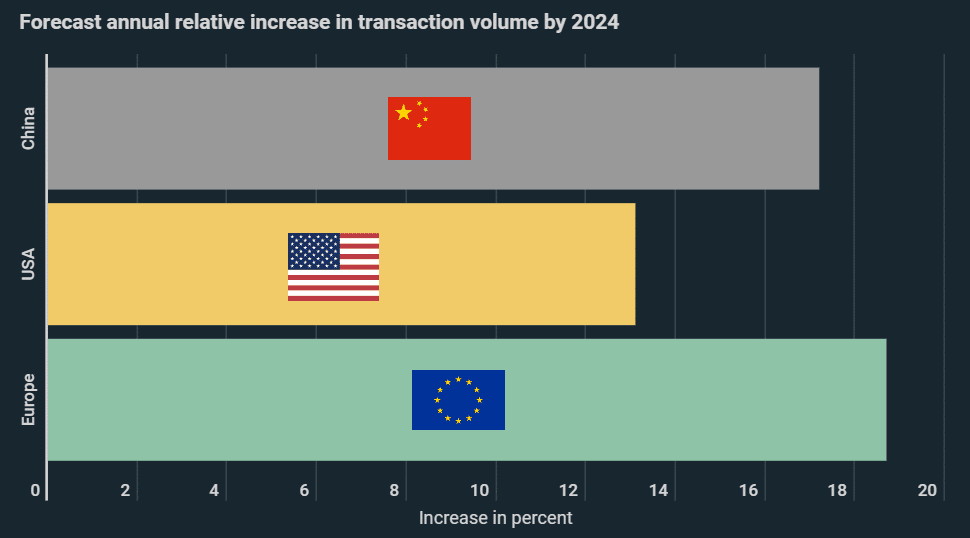

Last year, digital payments were used to turnover the equivalent of $666 billion US in Europe. According to a new infographic from Kryptoszene.de, this figure could rise to $1,572 billion by 2024, representing an annual growth rate of 18.7%. As the infographics show, the corona crisis could accelerate this growth trend even further.

According to a forecast in „Statista Digital Market Outlook“, the transaction volume for cashless payments in China will increase by 17.2% annually until 2024. By contrast, growth in the USA will be significantly lower at 13.1%.

The corona crisis is fuelling the trend – the number of cashless transactions has risen by up to 48% compared to last year. However, it remains to be seen whether this is a temporary phenomenon. Georg Hauer, head of N26 Germany, is convinced that the impact will be lasting: „Mobile banking will simply become the standard for banking in the future“. 8 out of 10 Fintech bosses believe that the pandemic will even improve business prospects.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Digital Transactions – Users According to Country

Meanwhile, the Statista survey reveals major differences between countries in terms of who is using digital payment solutions. In Germany, for example, men are the predominant group using such services (71.9%), while in China the ratio is much more balanced, with 52% of users male.

Fintechs in Europe

As illustrated, analysts expect the relational transaction volume to increase most sharply in Europe. Numerous Europe-based companies and neo-banks could benefit from this. While the sector is highly competitive, some notable Fintech firms such as N26 (Germany) and Revolut (UK) are European.

Folgen Sie uns auf Google News