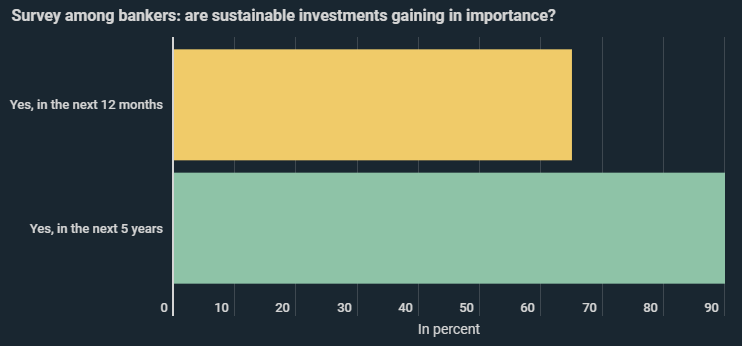

9 out of 10 bankers expect sustainability to become increasingly important to private investors over the next 5 years. Around 65% believe that we will already feel this in the next 12 months. This emerges from a new infographic from Kryptoszene.de. It also shows that recent investors into green shares have been able to achieve significantly higher net yields.

In the first 4 months of the Corona crisis, sustainable stocks climbed by 2.2 cents on average. During the same period, conventional oil and gas suppliers lost an average of 40.5 cents in value. The „Handelsblatt“ reported.

A look at price performance over the past 6 months also shows that renewable energy companies are enjoying counter-cyclical increases in share prices. The Global Clean Energy ETF rose by 22.4%, while the DAX and Dow Jones lost 5.6% and 4.8% respectively.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Sustainable investment in Vogue

The investment volume of sustainable investment funds in Germany last year was 63.2 billion euros, compare to just 20.6 billion euros five years ago. This was revealed by data from the Forum for Sustainable Investments (FNG).

As shown in the infographic, customer deposits with specialist banks focusing on sustainability have also increased 114% in the last 10 years.

Assuming the bankers are right in their predictions, this could just be the beginning of a longer-term trend. It is becoming clear these days that sustainable stocks are not only gaining in importance for investors, but are even performing above par.

Folgen Sie uns auf Google News