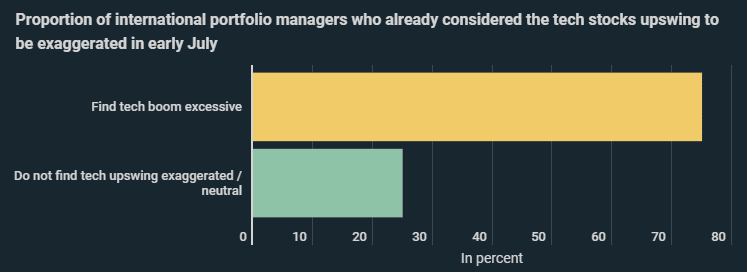

75% of international portfolio managers are wary of the rapid growth in tech stocks. Many professional investors have recently almost halved their investment quota, selling off a large volume of tech stocks in the process. A new infographic from Kryptoszene.de suggests some parallels with the dot-com bubble at the turn of the millennium. Meanwhile others merely see a healthy correction.

As recently as the beginning of May, asset managers were still showing a clear preference for tech stocks. According to a „FAZ“ survey, 35% of them believed that buying tech shares was „stongly advisable“. In contrast, 41% were in favour of modest investment. Certain companies‘ share price development proves that many investors followed words with deeds. The price of Apple shares, for example, climbed by a whopping 74.9% in a 6-month review. Meanwhile Facebook’s share price rose by 52.6% in the same period.

However the tide seems to be turning, and shareholders have had to accept corrections in recent weeks. The same applies to the aforementioned assessment from international fund managers. Data from Bank of America show that they now consider the tech rally to be overstated. The „Handelsblatt“ reported.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

High Demand For Tech Stocks

Meanwhile, Google data show that demand for tech shares is still reaching new heights across the board. The Google trend score currently stands at 100. Right now more people in Germany are searching for tech stocks than at any point over the last year.

The high demand is also reflected in market capitalisation. Listed US tech groups alone weigh in at $9.1 trillion US. According to „t3n“, this is more than the entire European stock market – including Switzerland and Great Britain and spanning all sectors, it should be noted.

Folgen Sie uns auf Google News