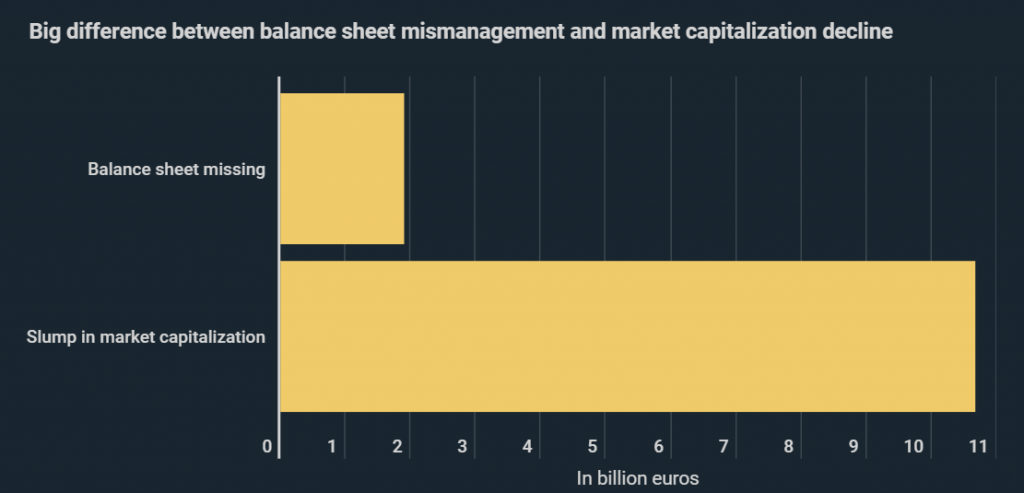

Within just a few days, Wirecard’s market value dropped by some 10.67 billion euros. This exceeds the company’s missing funds many times over, by 462% to be precise, as can be seen in a new infographic from Kryptoszene.de. Although Wirecard has since admitted that the missing 1.9 billion euros in escrow accounts supposedly do not exist, the question arises as to whether the market is overreacting.

On 18th June, Wirecard shares were still trading at around 100 euros. However the share price now stands at 14.65 euros. This is a price slide of historic proportions: within a single day, Wirecard shares lost 61.8% of their value. This marks the second-largest daily loss of any DAX stock ever, with Hypo Real Estate still holding first place in this regard.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Wirecard Demand Reaches Record High

Meanwhile, Google analyses show that search volumes for Wirecard have risen sharply. Within one week, relative search activity increased by 426%. As the infographics show, the Wirecard debacle has not only had an impact on demand for the German payment provider: competitor Ayden also recorded a similarly high surge in search volume, increasing by 300% in June. However while Wirecard is heading for a downturn, the price of Ayden’s shares rose by 5.8%.

Ayden is not alone in benefiting from the Aschheim-based company’s crisis. Above all hedge funds, which rely on falling share prices, have generated substantial profits. According to reports from „Handelsblatt„, short sellers could have made book profits of 2.7 billion euros on Thursday and Friday alone.

Shareholders Shaken by Wirecard

In addition to shareholders, financial institutions to whom Wirecard owes debt could also potentially lose out. In the event of insolvency, it is debatable whether the payment service provider has the necessary fund to service its debts to the banks. As shown in the infographics, Commerzbank, ING, LBBW and Deutsche Bank could be affected, along with others.

Although it is true that lost market value exceeds the value of missing funds on the balance sheet many times over, it remains to be seen whether the market is overreacting. An even greater loss could lead to a loss of confidence from cooperating partners.

Folgen Sie uns auf Google News