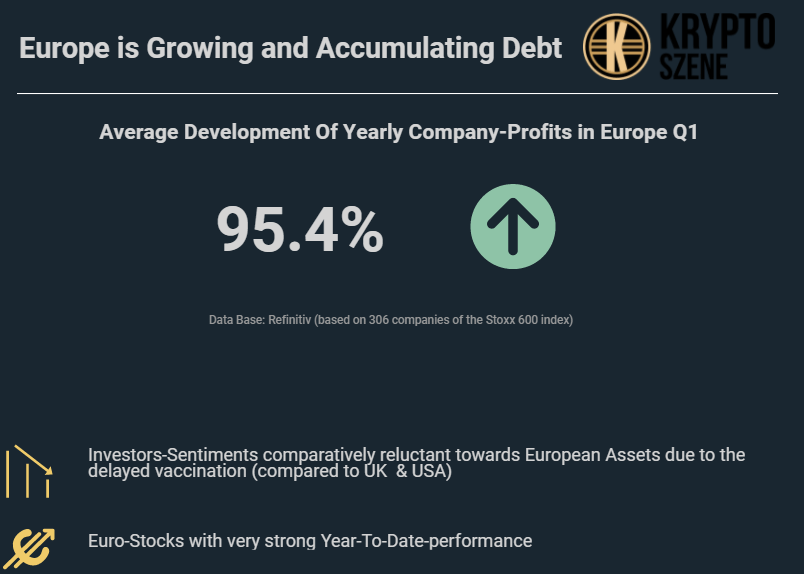

Europe seems to be emerging from the Corona crisis in good shape. As shown in a new infographic from Kryptoszene, European companies are not only performing convincingly in terms of extraordinary Q1 2021 earnings growth, which saw an average of 95.4% among 306 corporations in the Stoxx 600 Index. The value of European stocks also grew significantly faster than global counterparts. For example, with regard to year-to-date performance, an indicator of the latest trends, no world region was higher than Europe.

Europe Outpaces Other Parts of the World

According to the study, an investment in the MSCI Europe at the start of the year would have yielded a 14.15% return on the investment today. This puts European equities ahead even of North American stocks. The MSCI North America returned just 14.05% over the same period. Yet corporate shares around the world in general remain in a recovery phase. The MSCI World is currently gaining 12.34%. Even the beleaguered Pacific region is still performing well, with a gain of 3.92% for the MSCI Pacific.

„One of the main drivers of the current upward trend in prices is most likely the increase in European production,“ explains Raphael Adrian, editor-in-chief of Kryptoszene. „After sharp declines in sales among certain high-production companies in 2020, order books are quickly filling up again this year.“ In April 2021, production actually increased by a whopping 42.3%.

National Debts Climb to Record Level

Unemployment figures should also start improving again. According to current figures and forecasts by the EU authority Eurostat, unemployment rates throughout Europe are likely to rise again in 2021, before falling sharply again next year. For example, an unemployment rate of 4.1% is forecasted for Germany this year, which should then fall to 3.4% in 2022. In 2019, prior to the pandemic, the figure was around 3.1%. A similar pattern is emerging across the European Union, albeit at higher levels. In 2019, the unemployment rate across the EU still stood at 6.7% before rising to 7.1% in 2020, and is expected to be around 7.6% this year. There should a significant fall to 7.0% in 2022.

However, the economic recovery has come at a price. Public debt within Europe has risen to a new record level in the wake of the measures taken to deal with the Corona crisis. In the Eurozone area as a whole, it now stands at 102.4%, compared to just 85.8% in 2019.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Folgen Sie uns auf Google News