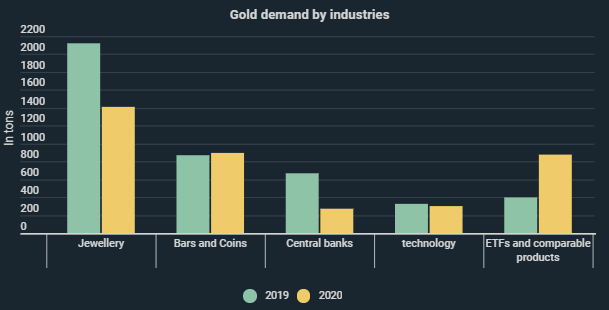

Global gold demand has reached an historic low, with levels unheard of since 2008. As shown in a new infographic from Kryptoszene.de, demand over the course of the past year of the Corona crisis amounted to 3,759 tonnes. This represents a decrease of 14.1% compared to 2019. It is only thanks to higher demand from the financial industry that an even greater decline was averted.

The reduction in demand from the jewellery industry has been especially sharp. Whereas the sector used 2,122 tonnes of gold in 2019, it only needed 1,411 tonnes in 2020. The demand for the precious metal in the technology sector was also somewhat lower. A contrary development, however, can be seen in financial investments, as shown by current data from the World Gold Council.

ETFs and comparable products bought up 877 tonnes of gold overall in 2020. This is 120% more than in the previous year. Gold seems to be enjoying increasing popularity among investors and living up to its reputation as a crisis currency.

Germany’s Affinity for Gold

Meanwhile, the infographic reveals that the Federal Republic of Germany has the second largest gold reserves in the world, with total stocks of 3,362 tonnes. Only the United States of America has more, with 8,133 tonnes in reserve. Italy is in third place, followed by France and Russia.

The European Union and the European Central Bank also depend on gold. The equivalent value of such reserves amounts to around €25 billion, as published by the „Deutsche Bundesbank“.

A survey by the World Gold Council reveals that gold is not only popular with older people. The survey found that as many as 38% of Germans between the ages of 18 and 24 intend to invest in gold. Gold seems to be on the rise as an investment product – reduced demand could simply be a result of the shutdown of numerous industries due to the Corona pandemic.

Folgen Sie uns auf Google News