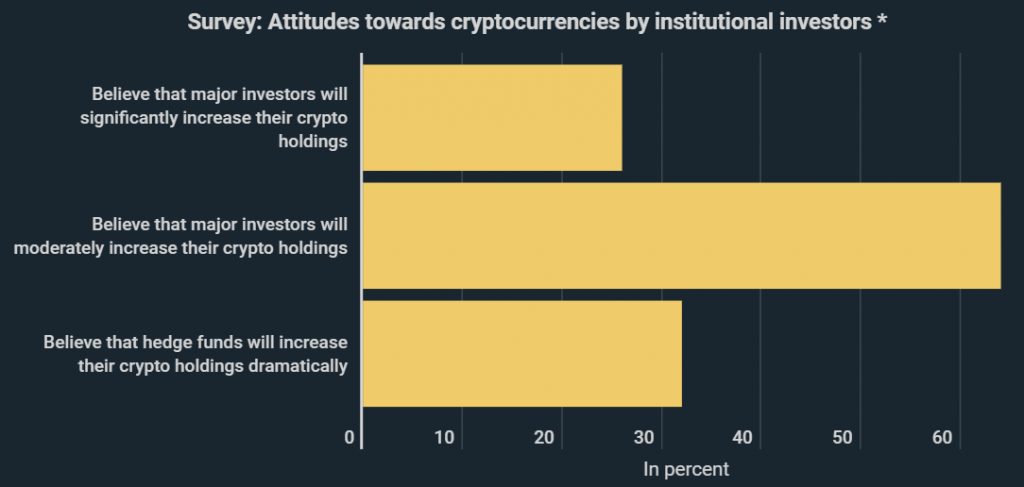

26% of institutional investors expect major investors to „significantly increase“ their cryptocurrency holdings. As a new infographic from Kryptoszene.de shows, a large difference between the behaviour of institutional and small investors has only recently become apparent. While the latter are standing by, the heavyweights have taken advantage of the corona crisis to make massive purchases.

Large investors took advantage of volatility to buy BTCs. As bitcoin prices approached the $10,000 mark, the number of transactions rose by between 1,000 and 5,000 BTCs. According to a survey by Evertas, there was no fluctuation in the number of medium and small transactions.

The same study also looked at why major investors are predicting an upswing for the cryptocurrency market. 84% of them are convinced that a superior regulatory infrastructure makes investing more attractive. Meanwhile, 76% consider negative interest rates and low bond yields to have a positive impact on the development of many cryptocurrencies such as bitcoin.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Sharp Increase In Bitcoin Trading Volume

A look at the Bitcoin trading volumes shows that many investors have put their money where their mouth is. In August, this equated to $191.2 billion US, a rise of 75% compared to the same month last year.

The growing interest of major investors is also having an impact on the distribution of the assets. According to data from „Bitinfochats„, the richest 0.01% of BTC addresses now own 42.73% of all coins in circulation. In September last year – as reported by Kryptoszene.de at the time – 41.78% of all bitcoins were held in the top 0.01% of addresses. It seems as though the gap between rich and poor is widening for bitcoin too. Should institutional investors indeed drastically increase their holdings, this trend could become even stronger.

Folgen Sie uns auf Google News