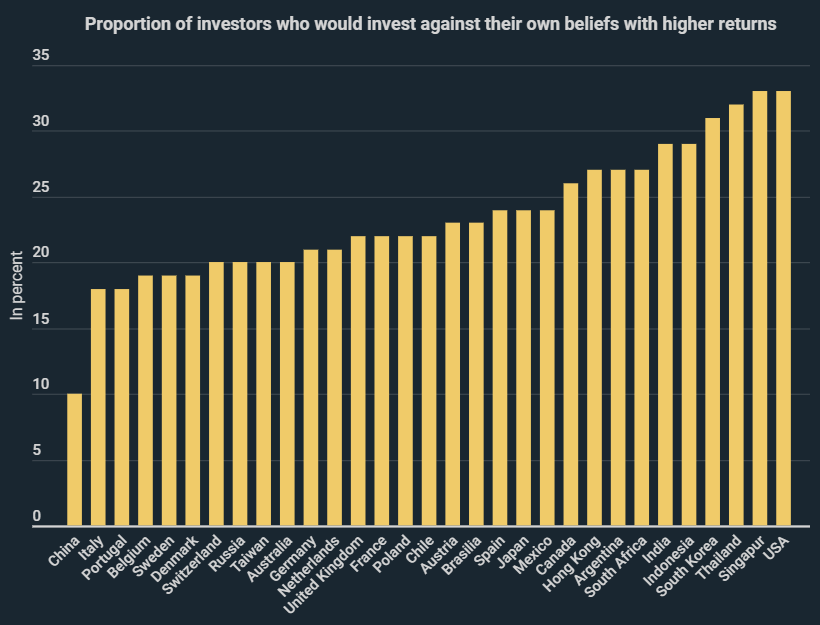

33% of US citizens would invest against their own morals to make higher returns. The Chinese are at the other end of the scale: In the Middle Kingdom, just 10% of citizens would invest in assets that contradict their beliefs. In Germany, on the other hand, the figure is 21%, according to a new infographic from Kryptoszene.de.

The infographic reveals that young people are more likely to invest contrary to their own principles. Among those aged between 18 and 37, 25% of people worldwide would be willing to go against their morals if this would have a positive effect on the return achieved. This was revealed by data from the „Global Investor Study 2020“. Willingness to act against one‘ s own beliefs appears to decline with increasing age.

Morally Questionable Stocks

However, a comparison of yields indicates that controversial sectors do not necessarily produce higher yields. The MSCI World Tobacco index has lost 1.6% of its value over the last five years. In the same period, however, the DAX has climbed by 24.4%. The picture is different, however, for stocks in the defence sector; the price of the Aerospace & Defense ETF increased by 66.8% over the past five years.

While this reveals little about possible shareholder structure, the five arms manufacturers with the highest turnover all come from the United States of America. A Chinese company is in 6th place.

German Preferences

Germans take a thoroughly critical view of investments in arms companies. 36.9% of Germans would withdraw their money from a fund if they knew that it invested in ethically questionable products – for example in the arms industry. Another 15.7% are not entirely sure, but would „more likely“ withdraw their money. A further 15.1% of German citizens emphasised that they would „definitely not“ withdraw their money. This was the result of a survey commissioned by „T-Online“ and conducted by „Civey“.

Folgen Sie uns auf Google News