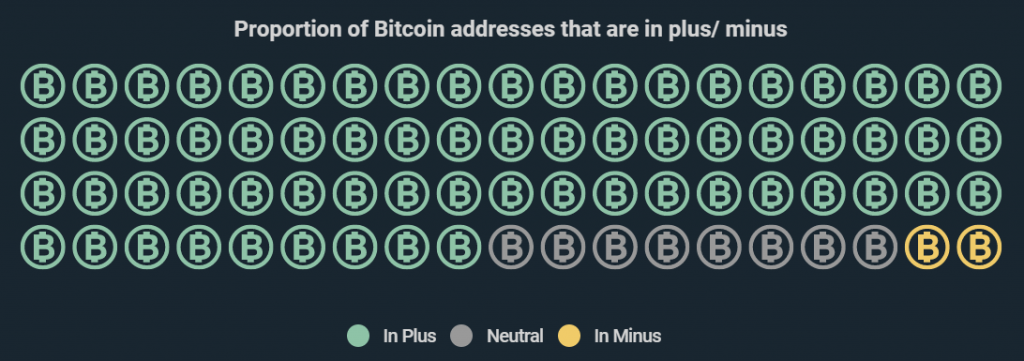

Around 86% of all Bitcoin addresses have turned a profit. Regardless of this performance, just 16% of Germans have faith in the price stability of digital currencies – back in 2017 twice as many were confident about the integrity of such currencies, according to a new infographic from Kryptoszene.de.

The proportion of people making transactions using cryptocurrencies has also decreased sharply. According to a survey conducted by „Bearing Point“, 4% of Germans actively use cryptocurrencies, compared to 11% in the year 2017.

While digital currencies are generally regarded critically, 86% of German citizens have faith in national currencies. Only gold enjoys a higher degree of trust, with 87% putting their trust in the precious metal.

Cryptocurrencies and Appraisals from Financial Market Specialists

However, a survey of members of the German Association for Financial Analysis and Asset Management (DVFA) suggests that even financial market specialists have their reservations. Only 15% consider cryptocurrencies suitable for financial investments. While another 10% are undecided, the remainder believe Bitcoin & Co. are “not at all” or “not very suitable”. As the infographic indicates, 14% of these financial market specialists are planning investments in cryptocurrencies over the next 12 months.

Positive Trend for Bitcoin

Looking beyond investors’ skepticism, Bitcoin, the number one digital currency, is the asset of the hour. Within the last 365 days, the BTC price has risen by 48.5%. Its performance even surpasses that of silver and gold – assets generally considered to be crisis currencies. The gains for the precious metals over the period were 34.1% and 26.5% respectively.

Folgen Sie uns auf Google News