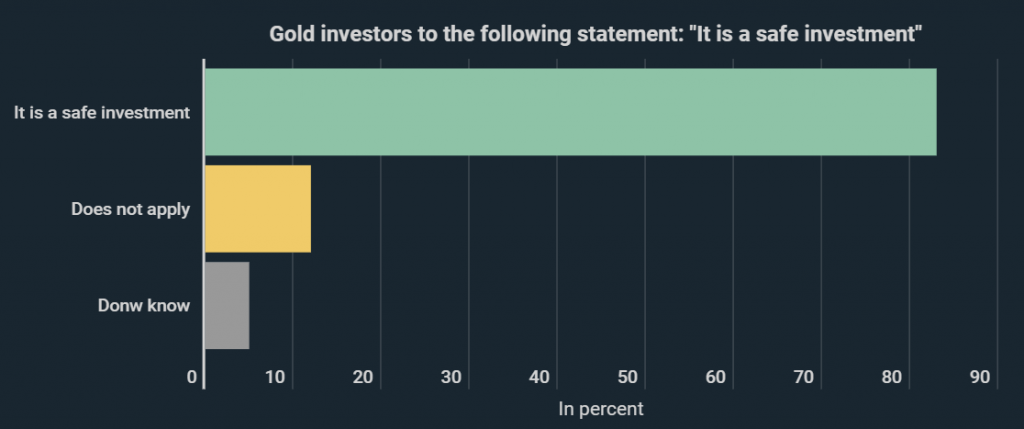

83% of gold investors in Germany consider the precious metal a safe investment for their capital. However, the Federal Financial Supervisory Authority (BaFin) is warning of a certain risk. This is shown in a new infographic by Kryptoszene.de.

Germans continue to be optimistic about the outlook for the price of gold. 31% even expect the coveted precious metal to outperform stocks, fund units and bonds over the next three years, according to a representative survey by „Pro Aurum“.

Interest is also picking up worldwide. This is not least reflected in increased gold holdings in ETFs around the world, with more gold held by such publicly-traded funds last year than ever before.

Gold as a Defensive Asset

Willingness to take risks, already low in Germany, has further diminished in the face of the Corona crisis. As shown in the infographic, 61% of Germans state an elevated desire for security due to Covid-19. Consequently, 44% are more interested in investing in gold than they were before the outbreak of the pandemic. This is based on data from a survey conducted by Quirion Privatbank.

While investors regard gold as stable and safe, the BaFin takes a different view. As the infographic shows, the body describes investments in precious metals as risky and speculative, and as being „all illusion and no substance“.

Folgen Sie uns auf Google News