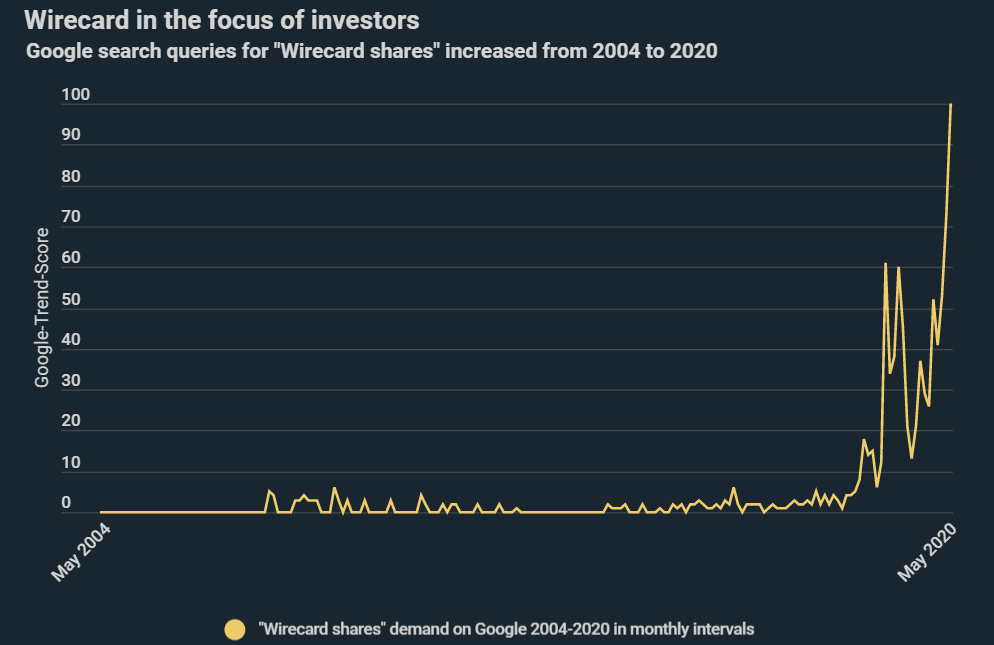

Google searches for „Wirecard stocks“ have soared by up to 284% since December 2019. The DAX company’s shares have never been as popular as in May 2020, according to a new infographic from Kryptoszene.de. The superlatives keep coming for Wirecard stocks: their gains are the strongest out of the entire DAX over the last 10 years, having risen by around 905% over the period.

However, infographics simultaneously show that shareholders are experiencing swings in both directions. While the volatility index for DAX companies ranks 33 on average, the volatility index for Wirecard is 105. Volatility for Wirecard shares outstrips the average across the leading German share index by 218%.

Data from the „Bundesanzeiger“ indicate that there is a high proportion of short sellers. Hedge funds are betting heavily on prices falling, with short sellers accounting for 10.67% of the total portfolio of publicly available Wirecard shares.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Wirecard Share Price Performance in Peaks and Troughs

A look at the latest share price development figures illustrates high degrees of volatility. On 13th February the stock was trading at Euro 143.85, and by 18th March it had dropped to Euro 83.20. About one month later, the share price was again around 66% higher – only to reach a temporary low of EUR 76.70 a few weeks later. Another infographic from Kryptoszene.de shows that, in spite of all the turbulence, shares in the payment service provider have performed consistently well in the past.

Balance Sheet Discrepancies Causing High Volatility

The Financial Times‘ accusations in particular seem to be affecting the group. There is talk of mistakes or concealments in balance sheets, and a recently published KPMG report, originally intended to dispel doubts, has also failed to provide any certainty. Numerous major shareholders, including DEKA, are thus calling for resignations from senior management.

Meanwhile, Wirecard partner Al Alam from Dubai announced on Friday that it would go into liquidation. Wirecard generates a substantial portion of its sales revenues from third-party business, according to „WirtschaftsWoche„, and Al Alam had been their most important partner. Even though Wirecard stresses that this will not affect the DAX Group’s business, the economic crime does not seem to have come to an end yet.

Folgen Sie uns auf Google News