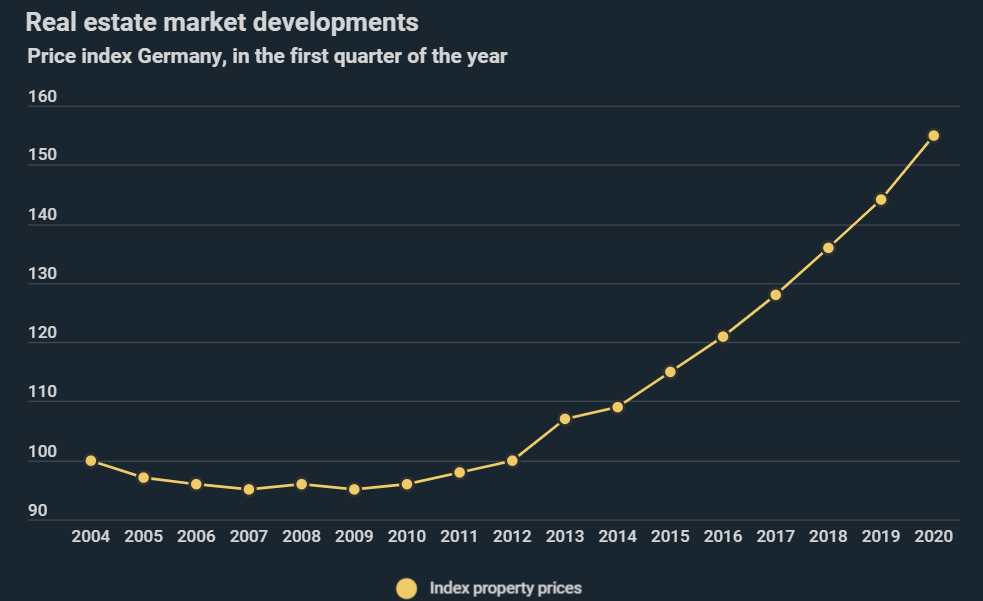

Real estate prices in Germany have never, since the first records of the property price index in 2004, increased as sharply as from 2019 to 2020, according to a new infographic from Kryptoszene.de. Even though the number of residential listings decreased by up to 16.8% in the wake of the corona crisis, Google search queries for real estate are actually at an all-time high. This can also be seen in the infographics.

Within the last year, the real estate price index has gained eleven points. There has never been a higher increase in such a short period of time. The index is calculated using a weighted average of purchase and rental prices, with data collected by the research institute „Empirica„.

At the same time, demand for real estate is at a record high. The Google Trend Score, which indicates relative search volume, is at the highest possible level of one hundred. This applies to the pairs of terms „buy house“, „buy flat“, „rent house“ and „rent flat“.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Property Prices – Corona Consequences May Be Unforeseeable

Nevertheless, the infographics show that despite the recent rise, various players in the market are expecting property prices to fall. According to a study by „Deutsche Wirtschaft„, possible insolvencies and rising unemployment could lead to a drop in residential property prices by up to 12%.

Swiss real estate investors also seem to be remaining critical. One survey, for example, revealed that 24% expect prices to fall overall, while only 9% expect real estate prices to continue to rise. However, according to the results of another study conducted in Switzerland, around 70% say that the corona crisis has not changed their intentions to buy.

New Listings Betray Caution

It remains to be seen how property prices continue to develop. It can however already be seen that fewer properties – both for rent and for sale – have been on the market during the pandemic than before the crisis. For example in Switzerland, 16.8% fewer advertisements for rental apartments were posted between 12 February and 16 April than in the same period last year. Empirica’s data suggests that there was also a significant slump in advertisements in Germany.

Folgen Sie uns auf Google News