Payment service provider PayPal generated in the Q4 2019 $4.96 billion of net income – about 13.3% more than in the previous quarter. PayPal also enjoys substantial growth in the number of transactions, sales, and other parameters, as shown on the new infographic by Kryptoszene.de. Shareholders currently do have to suffer price losses of up to 18%. However, other tech stocks and corporations seem to be suffering from more severe consequences.

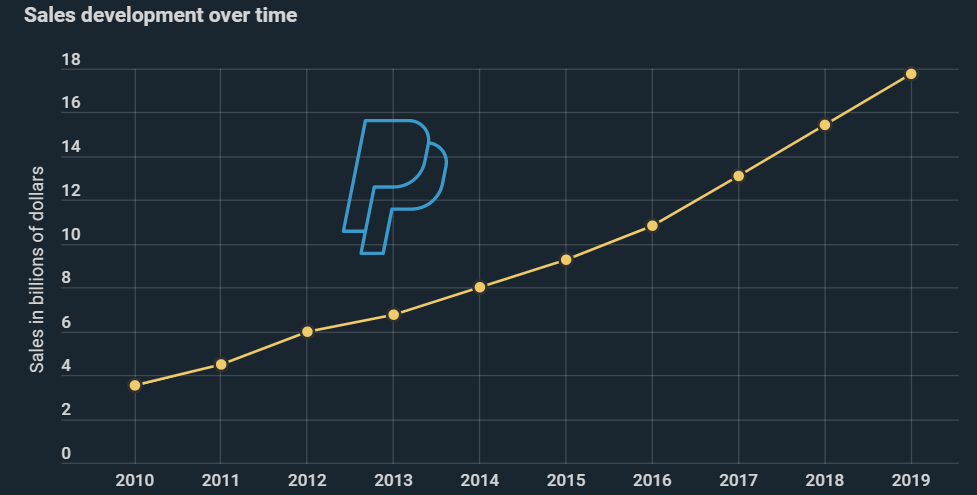

PayPal sales have increased by 406.27% since 2010. Overall, the group reached $17.77 billion in sales last year. The quarterly figures PayPal recently published make it clear that their sales and profits continue to grow.

The annual payment volume via PayPal is higher than ever. Last year’s total volume – $712 billion. According to the Statista Global Consumer Survey, PayPal is extremely popular among US citizens who use online payment services. 89% of respondents have used PayPal within the past twelve months, while Amazon Pay and Apple Pay have been used by 27% and 20% of respondents, respectively.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Demand for PayPal Shares Is High

Research by Kryptoszene.de based on Google Trends data shows that the relative search volume for „PayPal shares“ has recently peaked. In the period between January 26 and February 1, the term search has reached its peak position for the last 365 days. Even in the period from the 26th to the February 29, Google demand for PayPal shares was high: The Google trend score climbed to 93, with 100 representing the highest possible demand.

In the meanwhile, PayPal is still struggling with the recent price drops caused by the coronavirus pandemic. In the past four weeks, the PayPal market value decreased by around 18%. However, this payment service provider is not alone. Other US tech companies seem to be even more affected. For example, the value of Mastercard shares decreased by 23.47% in the same period. At Facebook and Google, the loss is 22.26% and 20.55%, respectively.

Folgen Sie uns auf Google News