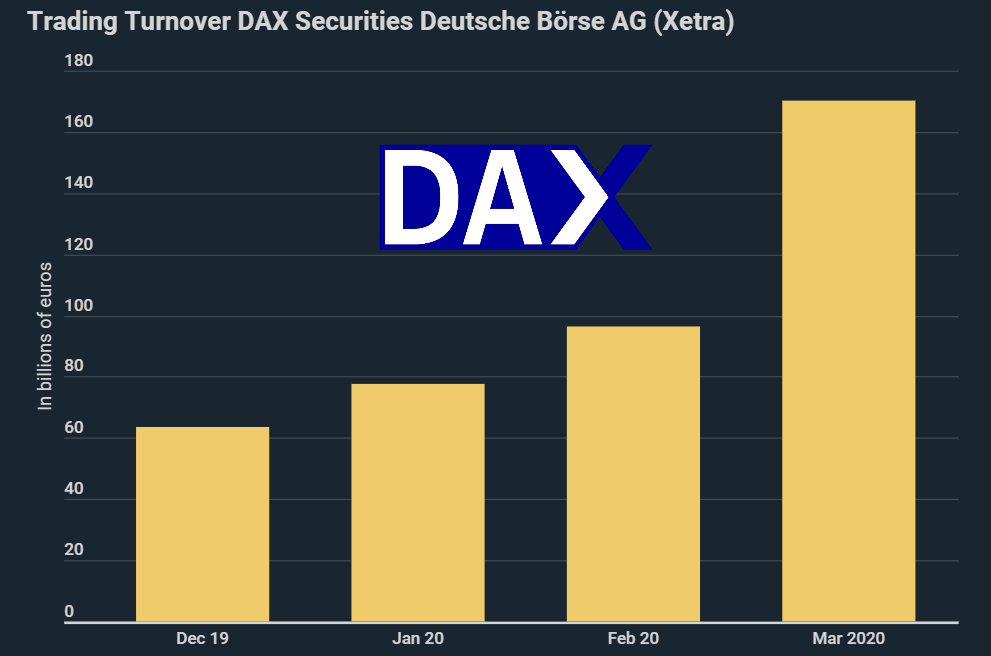

Around €170 billion worth of DAX shares were traded via Deutsche Börse AG in March. In contrast this figure was a mere €63.5 billion in December of last year. As shown in a new infographic from Kryptoszene.de, trading volumes for ETFs have also increased substantially. The company’s turnover in March was 189% higher than in the same month last year.

The rising demand for shares is not only reflected in stock exchange revenues. It is also clear in the Google data: particularly since the stock market crash on 19th February Google Trends scores, indicators of relative search volume, have risen sharply. You can see in the infographics that German and global demand are following similar patterns – at least in principle. In March 2020, search queries both for „Aktien Kaufen“ and „Buy Shares“ achieved a Google Trends score of one hundred, the highest possible relative search volume.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Winners of the Crisis Are Not the Only Ones Arousing Interest Among Investors

Data from „Boerse.ard“ show that Wirecard shares are of particular interest to investors, with the payment service provider ranking first among all searches for bonds over the past four weeks. There is also keen interest in shares from a number of companies suffering from the effects of the Corona pandemic. Thus, investors searched for Lufthansa shares the second most frequently, followed by Daimler. In a ranking of demand, Amazon is ranked ninth. According to many analysts, the group seems to be profiting from the effects of the extraordinary current situation.

Growing Interest Not Only in Stocks, But Also in Cryptocurrencies

The study indicates that interest from investors in digital currencies is also increasing. This is manifesting itself not only in higher trading volumes compared to the months before the Corona crisis, but also in an rising number of visitors to platforms offering information on cryptocurrencies. Total visits to „BTC-Echo“, „Kryptoszene“ and „Coincierge“ rose by up to 87% on average between December and March.

Folgen Sie uns auf Google News