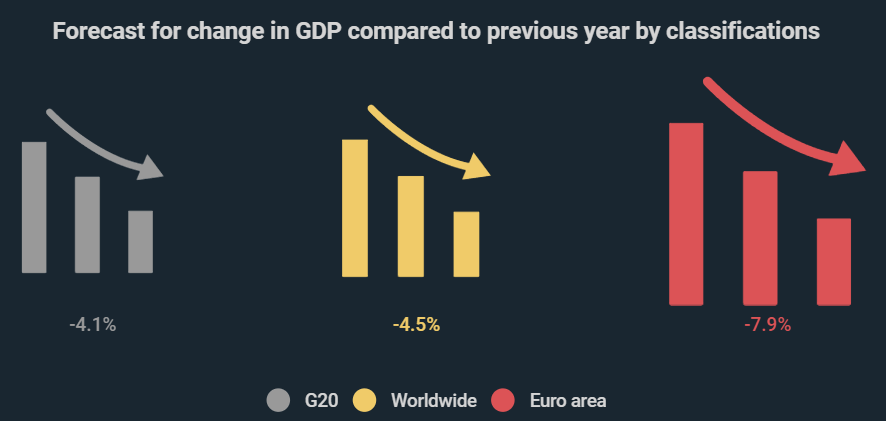

Gross domestic product (GDP) in the euro zone is set to fall by up to 7.9% year-on-year. As a new infographic from Kryptoszene.de shows, China is the only country experts expect to see a rise in GDP. A glance at the price development of stocks from the Middle Kingdom also indicates that China appears to be emerging relatively unscathed from the corona crisis.

The decline in Germany’s GDP will amount to around 5.4%, according to a current OECD forecast. Countries such as France and Great Britain will be significantly more severely affected. According to the forecast, GDP in these countries is set to fall by around 9.5% and 10.1% respectively. The forecasted increase in China is 1.8%.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Effects of the Corona Crisis on Share Price Performance

However, the infographic shows that trends on the trading floor vary considerably from state to state. The Chinese SCI index has risen by 10.5% over the last 365 days, while Germany’s leading index DAX also recorded a positive result with an increase of 6.7%. The situation is very different in the case of the UK and France – countries where the OECD experts predict a particularly sharp decline in GDP.

The British FTSE 100 lost 17.3% of its value over the year, while the CAC, which includes listed companies in France, lost 12.6%.

Corona Crisis Turns Expectations On Their Head

At the end of 2019, 42% of professional fund managers forecast European equities to outperform the market. In contrast, just 29% were optimistic about US securities.

Despite the projected decline in GDP and considerable losses in the prices of many shares, Germans do not seem to be concerned about an economic crisis. This is at least evident from analyses of Google search queries. The relative search volume for the term „economic crisis“ ranks extremely low. It was only at the peak of the pandemic – when Germany was imposing extensive initial restrictions – that citizens were concerned about this. At that point, the Google trend score, which indicates relative search volume, hit the maximum value of one hundred.

Folgen Sie uns auf Google News