The gap is huge: evaluations by Kryptoszene.de show that the average German net worth is $ 35,313. For comparison: Great Britain is at 97,452, Switzerland – 227,891 dollars. This is by no means to blame on the income. Even in Greece or Portugal, the citizens are wealthier. It shows that the Germans – world champions in export – get extremely low investment returns compared to other countries.

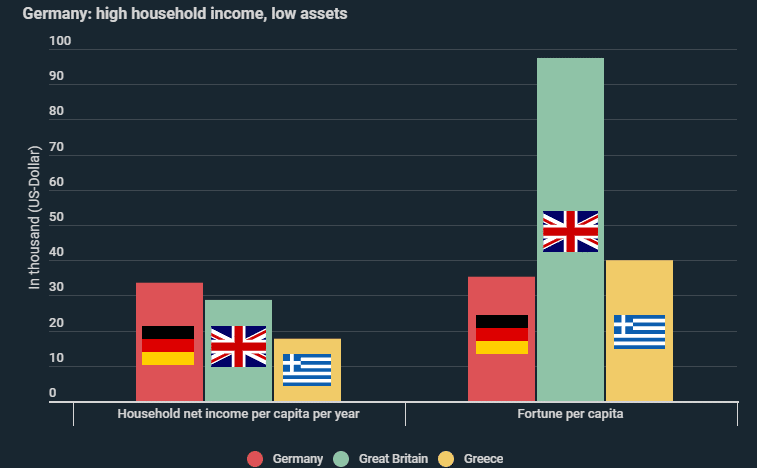

Yearly household net income per capita in Germany is $33,604, according to the infographic. This is about 17% higher than in Great Britain – and yet the British have significantly larger assets. One possible reason for this: Germans don’t properly invest the money. Although they invest a lot of capital abroad, they only generate an average annual return of 4.9%. The situation is very different in Great Britain and the USA, where the annual return is 10.2% and 10.6%, respectively.

!function(e,i,n,s){var t=“InfogramEmbeds“,d=e.getElementsByTagName(„script“)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(„script“);o.async=1,o.id=n,o.src=“https://e.infogram.com/js/dist/embed-loader-min.js“,d.parentNode.insertBefore(o,d)}}(document,0,“infogram-async“);

Germans‘ Bad Investment Choices Show Themselves in The Long Run

Calculations by Kryptoszene.de show how the wealth gap increases over time with these differences in returns. Germans who invested $10,000 in 1975 could now look back at a handsome fortune of $86,078 with an average return of 4.9%. With a return of 10.2% (Great Britain), the assets would have already increased to $871,167.2. This would increase even more with the average return achieved by the Americans. Namely: to just under a million, more specifically to $931,066.

There Are Many Reasons for The Germans‘ Lack of Assets

Comparatively smaller assets in Germany can have many reasons. However, especially in international comparison, Germans have a few specific characteristics. According to the infographic, they often prefer low-interest savings books, don’t own a lot of property, are more skeptical about new assets such as cryptocurrencies, and buy shares far less often than, for example, Americans.

Only around 9% of Germans own shares. On the other hand, 55.2% still use a savings book. This is despite the fact that the interest rate was only 0.2% last year, and DAX shares, in the meanwhile, increased at a rate of 9% annually in recent years and decades.

Overall, it turns out that Germany’s economic strength is not reflected in the financial situation of its citizens. From the savings book affinity to the inflation rate, it won’t be far-fetched to say that the Germans are walking themselves into poverty by their savings choices. Nice thought, poor implementation? Perhaps, the greatest risk in building wealth is not wanting to take any risk at all.

Folgen Sie uns auf Google News